Key Takeaways

A winning Powerball ticket worth $1 million was redeemed with the Hoosier Lottery in Indiana just five hours before the paper ticket slip was set to expire.

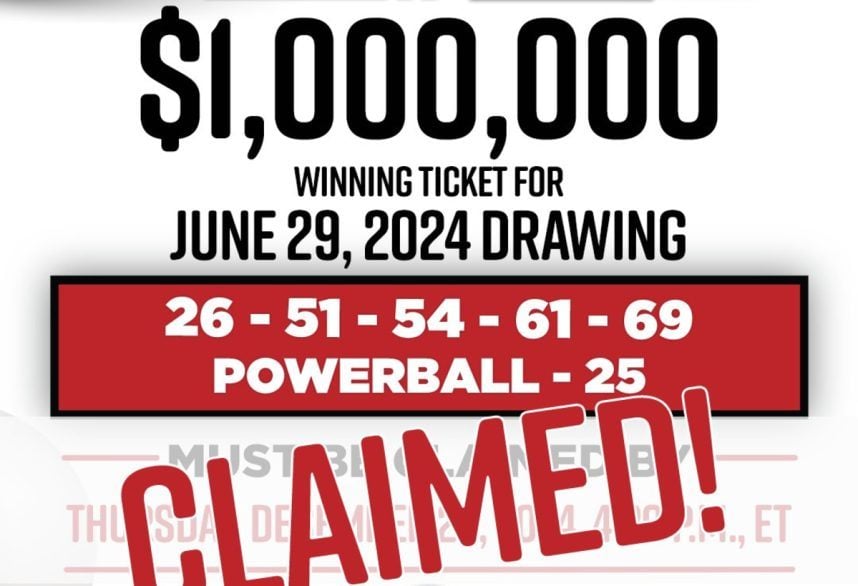

A Powerball ticket worth $1 million was redeemed just hours before it was set to expire on Dec. 26, 2024. Indiana s Hoosier Lottery says the winners fortunately found the ticket on Christmas Day. (Image: Hoosier Lottery)

A Powerball ticket worth $1 million was redeemed just hours before it was set to expire on Dec. 26, 2024. Indiana s Hoosier Lottery says the winners fortunately found the ticket on Christmas Day. (Image: Hoosier Lottery)In what was one of the more heartwarming of the 2024 season, officials with the Indiana lottery say a couple from Kendallville arrived at the Hoosier Lottery Prize Payment Office in downtown Indianapolis on Dec. 26. The couple, who wished to remain anonymous, said they found the ticket on Christmas Day after searching for the slip for several days.

The Powerball play matched the five white balls during the June 29 drawing 26, 51, 54, 61, and 69. Had the ticket also matched the red 25 Powerball, the winners would have claimed the $115.5 million .

The ticket sold in Indiana was one of two tickets that matched all five white balls during the drawing. The other was sold in New Jersey. Both did not purchase the optional $1 add-on Power Play that would have doubled their payouts to $2 million.

PSA WorksUnlike in many states that provide lottery winners with up to a year to redeem their winning tickets, Indiana s lottery law requires redemption to occur within 180 days of the drawing. As the Dec. 26 deadline approached, the Hoosier Lottery launched an extensive communication drive to warn players that a seven-digit windfall .

The couple had seen news coverage and signage at the local gas station about the unclaimed Powerball ticket starting about a month ago. While the convenience store is not a location they visit often and they were not certain they purchased a ticket for that specific Powerball drawing, they took time to look around for the ticket. The search was not successful, and the couple assumed they did not even buy a ticket for that drawing, a statement from the lottery explained.

Just prior to Christmas the couple again heard the ticket was unclaimed and about to expire. They decided to search again. Waking at 4 a.m. Christmas morning, the couple searched their vehicle including deep between the seats. At that moment they realized they had a winning $1 million Powerball ticket in hand, the lottery continued.

The $1 million win is subjected to a federal tax of 37%. Indiana also considers lottery winnings as taxable income with a 3.05% tax.

Unclaimed WinningsCasino.org estimates that lottery tickets worth upwards of $3 billion go each year across the U.S. Most of the tickets are small in value, but the unredeemed winnings add up, as 45 of the 50 states have lotteries.

In 2011, a Powerball jackpot worth $77 million was not redeemed in Georgia before the ticket expired. Two years later, a $50 million Powerball ticket sold in Florida became worthless.

In 2022, a $68 million ticket in New York went uncashed, and the following year a $46 million Mega Millions prize sold in Brooklyn also remained at large as it expired.

When Powerball and Mega Millions wins aren t redeemed, the funds go back to the state lotteries that contributed to the pot. From there, most states use the proceeds for their own prize funds or for the programs they support.

States that have online lottery sales say digital tickets provide consumer protections, as wins are automatically credited and/or stored for the player. Online courier services can also help ensure players that their tickets are not lost.

55577.top